As a business owner or accountant, your easy access to a cloud-based accounting platform like Xero will give you the opportunity to manage your financial operations effectively.

Your business operations can be greatly simplified by Qoblex’s connection with Xero because it can correlate your inventory data with your accounting journal. Through this integration, you can easily manage inventories in Qoblex while ensuring accurate and current financial records in Xero.

To link your Xero account with Qoblex:

- Go to your Integrations module.

- Look for Xero on the list of integrations.

- Click Link to Xero.

- Proceed with linking your Xero account’s login information.

Managing your Ledger accounts

The following are what Qoblex automatically syncs to your Xero account. In order to have a smooth experience, we recommend you ensure the following ledger accounts exist in Xero first:

| Account type in your S&B | Account type in your Xero | Description |

|---|---|---|

| Sales accounts | Sales | Ledger account where sale invoices are sent to. |

| Payments accounts | Revenue | Ledger account where payment information are synced to. |

| Purchases accounts | Current Asset | Ledger account where purchase orders are synced to. |

| Stock On Hand account | Current Asset | Ledger account used to track your inventory value. |

| Manufacturing Cost | Expenses | Ledger account used to sync manufacturing cost (labor, services, machinery, etc.) |

| Cost of Goods Sold account | Expenses | Ledger account used to track your cost of goods sold. |

| Inventory Adjustments account | Expenses | Ledger account used to record irrecoverable stock such as loss, shrinkage and write offs. |

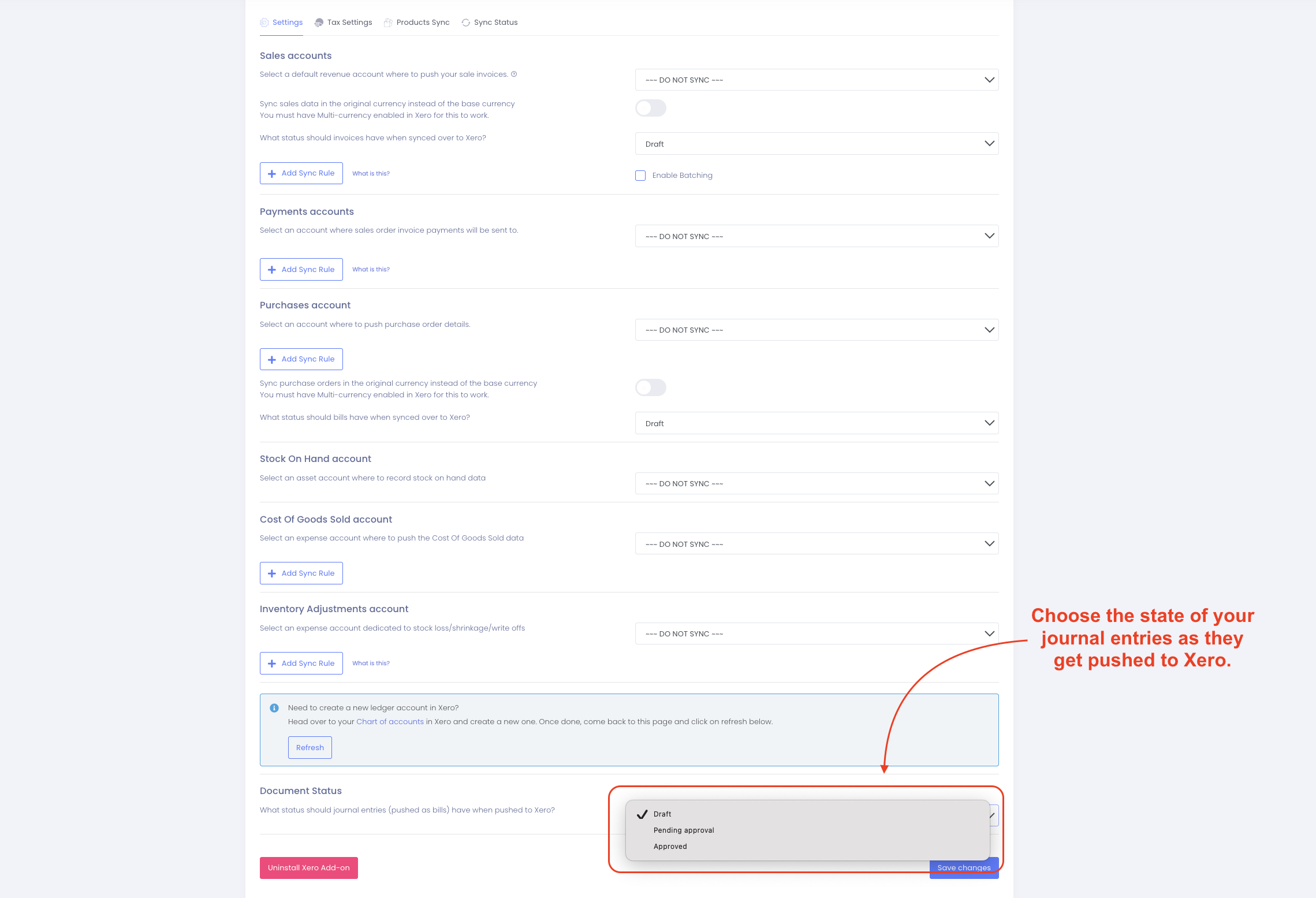

Once your inventory data has synced to Xero, Qoblex provides you control over their status. Whether you want them in a Draft, Pending Approval, or Approved state is up to you.

Sync Rules

You can add rules to each account (except Stock On Hand) by clicking the + Add Sync Rule box, giving you additional control over what and how your inventory data syncs with your Xero account.

We have separate articles that provide more details about setting up rules on the accounts. These will help you establish the proper rule for each one.

- Split Sales to different ledger accounts

- Split Payments to different ledger accounts

- Split Adjustments to different ledger accounts

- Split Purchases to different ledger accounts

- Split COGS to different ledger accounts

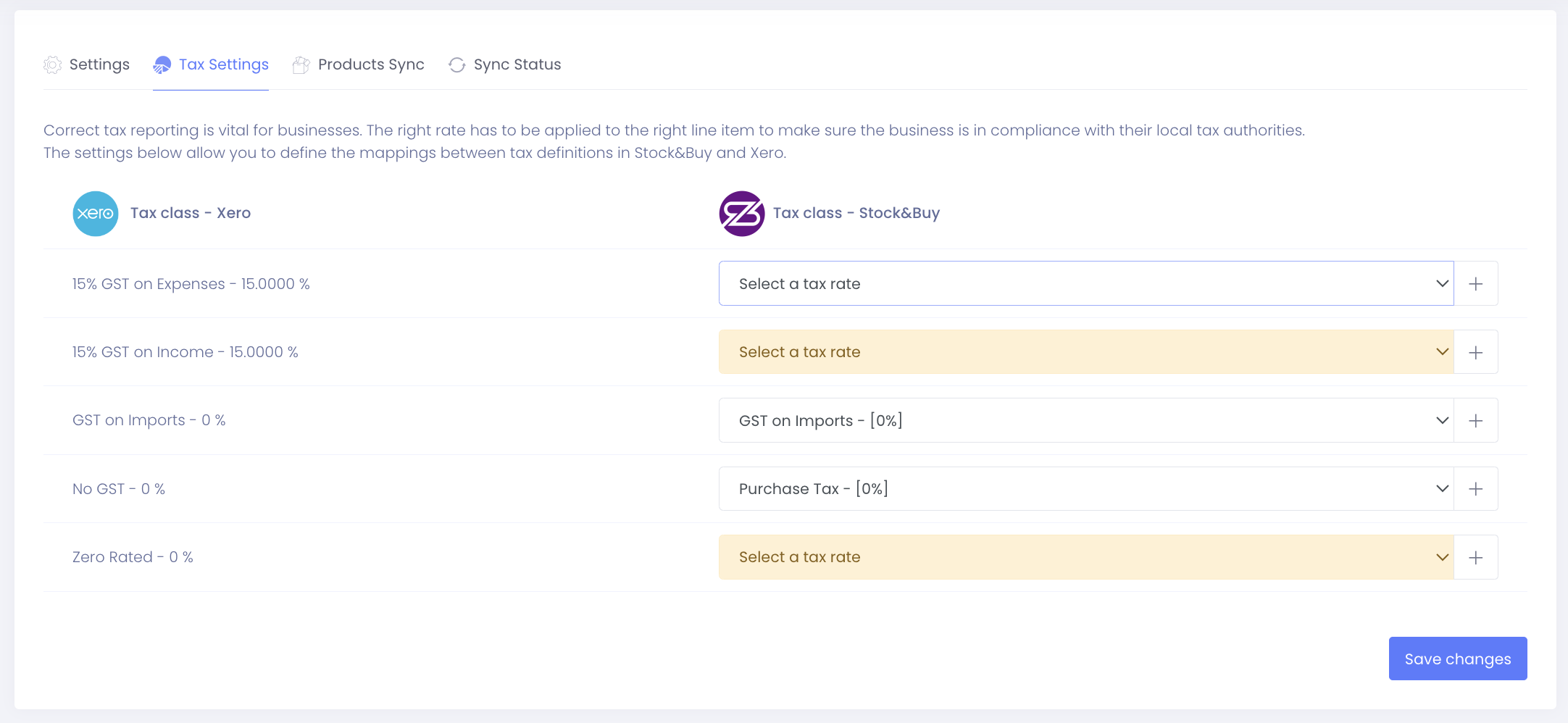

Tax Settings

Accurate tax reporting is essential for businesses. By providing the right rate for each line item, businesses ensure their compliance with their local tax authorities. In this integration, you can define how Qoblex and Xero’s tax definitions are mapped.

If your Xero version is US, Canada, or Global, then Qoblex will automatically push your tax definitions within Qoblex to Xero. This applies to both sales and purchases tax rates (also applies to orders coming from online shops such as Shopify).

Products Sync

This setting in the integration is optional. You can choose if you want your products’ information to sync within your Xero. The product name, sale price, and purchase price will all be updated by the sync.

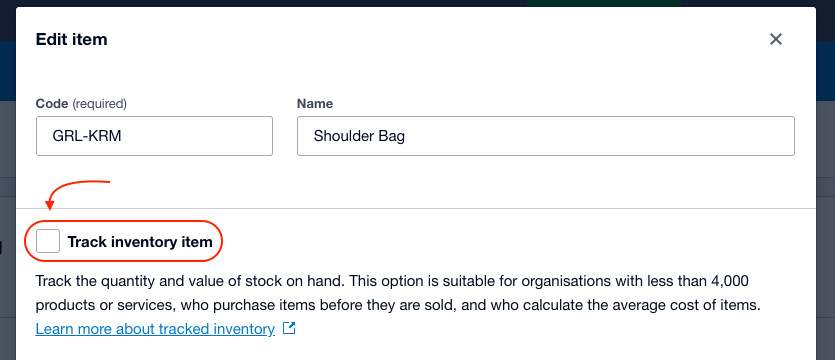

Turn off inventory tracking in Xero

While you’re able to sync your products’ information from Qoblex to Xero, we are unable to sync Xero’s inventory tracking. This can cause some errors on your sync if your products are tracked in Xero. You can choose to turn off your products’ sync or un-track your inventory items in Xero.

To turn off your inventory tracking in Xero:

- In Xero, navigate to Business > Products and Services.

- Select the product and click Edit Item.

- Leave the Track inventory item unchecked.

- Click Save.

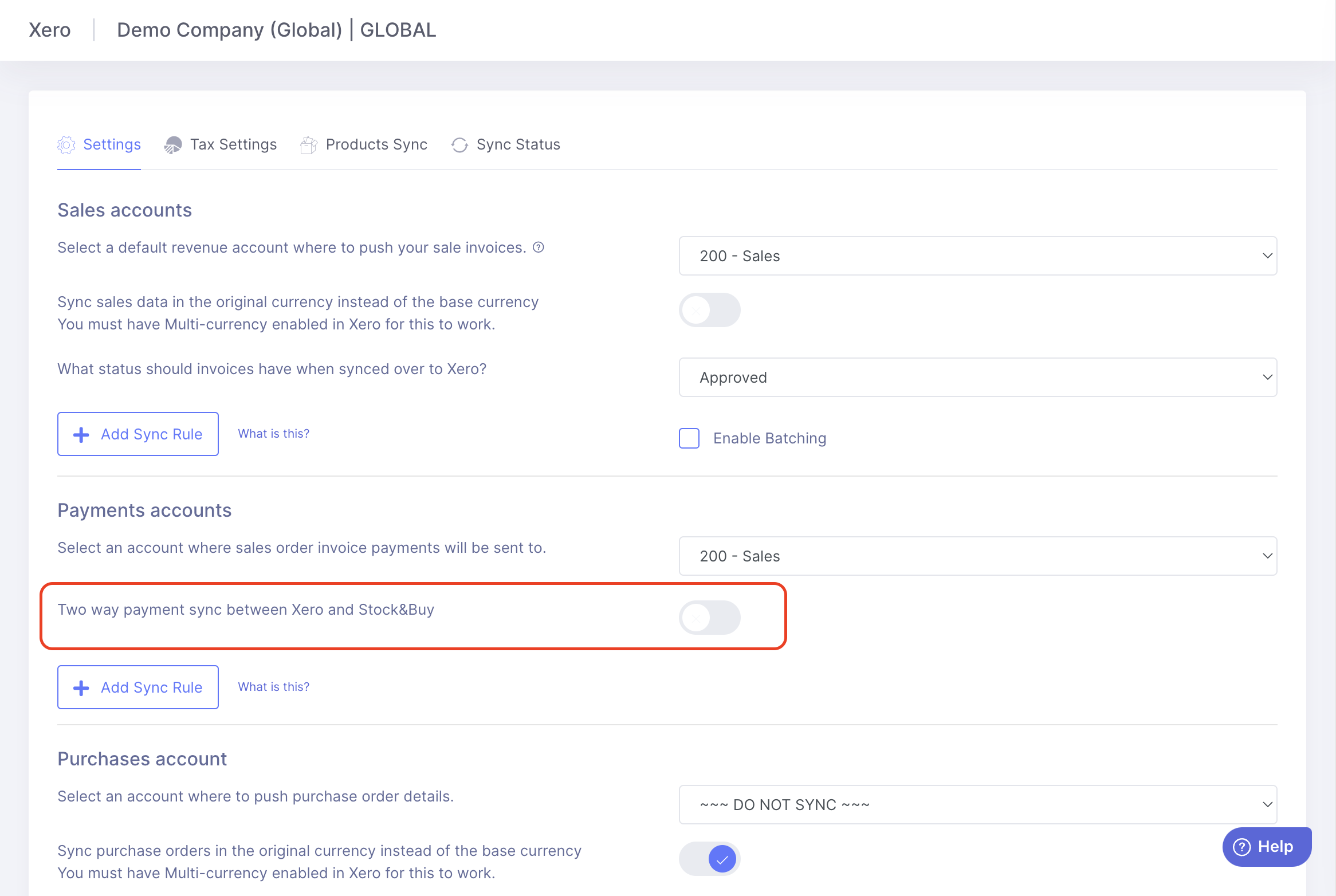

Two-way Payment Sync

You can synchronize your payments between your Qoblex and Xero accounts by enabling two-way payment sync. This feature updates payments in Qoblex when invoices are marked as paid in Xero.

Sync Status

On this page, you can check your orders’ sync status with your Xero. For the orders that failed to sync correctly, you can check the error messages in your Activity module.

How does the integration work?

Here are the common activities that are achieved when you sync Qoblex to your Xero account:

| Actions in Qoblex | Results in Xero |

|---|---|

| Approve a purchase order | A bill is created on your Purchases account. |

| Receive a purchase order | Creates a journal entry that moves the net amount (without tax) of the purchase order from the Purchases account to your Stock On Hand account. |

| Void a purchase order | Sets the corresponding bill back to Draft. |

| Authorize a supplier return | A credit note is created against your purchases account in Xero. At the end of the day, a journal entry is created to move the credit note value from the Stock On Hand account to the purchases account. |

| Invoice a sale order | An invoice is created against your Sales account in Xero. |

| Record a payment for a sale order | Marks the corresponding invoice as Paid in Xero and pushes a note to your payments account. |

| Void a sale order | Sets the corresponding bill back to Draft. |

| Create a sale refund | A credit note is created against your sales account in Xero. |

| Ship (fulfill) a sale order | A journal entry is created to move the order total cost of goods sold from the Stock On Hand account to the Cost of Goods Sold account. Any refunds attached to the closed order will result in a journal entry moving the total cost of the refund from the cost of goods sold to the Stock On Hand account (if the items are restocked) or the Adjustments account if the items is written off. |

| Create an adjustment | A journal entry is created moving the total adjustment value from the Stock On Hand ledger account to the adjustments ledger account. |

Synchronization timing

Every five minutes, Qoblex synchronizes sell and buy orders. Also, this happens whenever a sale or purchase order is modified.

Every day at 8:00 PM GMT, journal entries for Stock On Hand (SOH) and Cost Of Goods Sold (COGS) transactions are synced.

Reconciling Qoblex and Xero

We highly advise that you double-check your Stock On Hand value in Qoblex and make sure it matches your Stock On Hand balance in Xero to guarantee consistency in your inventory valuation between the two.

Once this is done, your total Stock On Hand across all inventory locations in Qoblex should always match the quantity reported in Xero.

You can check the following if the data on both services differ from each other:

- Verify transactions from Qoblex that are processed and approved in Xero. You can check the Sync Status tab to help you identify items that have not been processed.

- You can run an Account Transactions report in Xero for your Stock On Hand account. All transactions to this account must be from Qoblex, as it will result in an error if they’re posted from elsewhere.

- Make adjustments in Xero and monitor the balances going forward.